As the two-year-anniversary of the Blended Retirement System approaches, Military Times has checked in with some service members to see how they’re using their Thrift Savings Plan to further their retirement goals.

We put a call out for volunteers who were interested in seeing whether they’re on track for their retirement goals, and we put them in touch with professional financial advisers who reviewed their goals and their financial information. Those we talked to have at least one thing in common: they’re contributing at least 5 percent of their base pay in order to get the full Defense Department match of 5 percent.

Service members who entered the military after the beginning of 2018 are automatically enrolled in the BRS; those with fewer than 12 years of service as of Dec. 31, 2017 had the choice of opting in to the BRS, or sticking with the traditional retirement system. If you stay in long enough to retire, the BRS pays 20 percent less in monthly retirement. But one benefit of BRS is that you’ll have those DoD matching TSP funds to take with you, whether you leave before or after retirement. TSP is similar to a 401(k) plan in the civilian community.

Under BRS, DoD automatically contributes 1 percent of base pay, and (after the service member has served two years) matches up to an additional 4 percent of a service member’s TSP contributions.

These service members recognize that key point, and some are passing it along to others. One Air Force captain sits down with her airmen to talk about the importance of contributing to the TSP, getting the DoD match money, and how this money can grow over time. If you don’t contribute enough of your money to get the DoD match, you’re shortchanging your retirement, in effect leaving free money on the table.

Air Force captains Jose and Katrina

Jose, 33, is prior enlisted with 12 years of service. Katrina, 32, has eight years. Both are stationed at Holloman Air Force Base, N.M.; with one son, Lucas, born Nov. 27. Combined income: $170,000 annually.

Retirement snapshot:

Thrift Savings Plans

Jose (Traditional retirement): $138,474

Katrina (Blended Retirement System, BRS): $113,505

(DoD match and earnings: $6,683.12. Katrina’s contributions and earnings, $106,822.61)

Combined IRAs: $42,158

Other investments outside retirement: $266,676, including $30,000 in emergency funds, plus a rental property valued at $115,000, mortgage remaining of $87,000

Total investment assets including rental property equity: $586,241

The two are more than halfway to their goal of reaching $1 million in eight years, when they’ll be in their early 40s.

Their investments total about $558,000 in their TSP, Individual Retirement Accounts, and other investment accounts outside the retirement funds. Jose, 33 and Katrina, 32, have been maxing out their contributions to their retirement accounts for the last couple of years.

One is in the Blended Retirement System; the other stayed in the traditional military retirement system.

In early 2018, Katrina opted in to the new Blended Retirement System, in anticipation of possibly leaving the military within a few years. Her TSP account is now nearly $114,000, with about $107,000 of that coming from her own contributions and earnings over the last eight years, as she contributed at various levels. But also in less than two years of BRS, she’s racked up nearly $7,000 in DoD contributions and earnings within her TSP.

Jose, a prior enlisted captain with 12 years of service, chose to stay in the traditional retirement system.

Their combined military TSP accounts now total more than $250,000, and their IRAs total more than $42,000. Another $237,000 is in mutual funds outside of their retirement accounts, and $30,000 set aside in an emergency fund. The couple also own a rental property valued at $115,000, with a mortgage balance of about $87,000.

By the end of this year, they will each have contributed about $19,000 of their base pay to their TSP accounts – the maximum allowed by the Internal Revenue Service. Katrina receives the full 5 percent matching contribution from DoD.

As of the end of November, this year alone, a total of $21,617.86 was added to Katrina’s TSP. That includes her own contribution of $18,747.47 to her account, and the DoD matching contribution of $2,870.

Katrina realizes she made one miscalculation with her TSP this year however, causing her to miss out on some of the DoD match money for December. Because she was on track to contribute more than the allowed $19,000, her contributions were recently stopped. If the service member has to stop contributing because of the limits, that DoD match doesn’t happen. She cautions others to be aware of the maximums and the implications.

Between December, 2016 and August, 2017, the couple hunkered down and paid off $37,000 in car loans and a student loan. Before 2018, they hadn’t been consistently maxing out their TSP and IRA accounts, but that changed once they paid off their debt. “We have not been doing everything perfect since the beginning of our careers, but we’ve always contributed some each year,” Katrina said.

Their goal is to retire early. They also wanted to keep their options open when they start a family, in terms of whether Katrina will continue to work. Baby Lucas was born Nov. 27.

If they do fully retire when Jose hits 20 years around the year 2027, they plan to withdraw about $20,000 annually to supplement Jose’s military pension, which he estimates would be roughly $48,000 if he retires as a major.

The two try to be responsible with their spending and saving, but wanted to get a financial expert’s review to see if they’re currently on track to retire in their early 40s – even if Katrina leaves the military within a few years.

The recommendations

“You and Katrina have done a great job preparing for your future,” Kari Foust, a certified financial planner and financial adviser with Navy Federal Financial Group, told the couple.

There’s a 99 percent probability that they will be able to fund all their goals, within their time frame — with Jose possibly retiring in 2027. For them, that means reaching $1 million.

Meanwhile, Foust recommends an emergency fund equal to three to six months of income, set aside in an easily accessible account. Although the two are considering pulling out perhaps $500,000 from their stash to later buy their dream home, Foust recommends they instead get a mortgage when the time comes, if interest rates are low enough, to leave their money to grow in the market.

They should continue building retirement funds inside their Roth IRA accounts and TSP accounts for tax-free growth, Foust suggested. If Katrina stops working, Jose should make spousal contributions to her Roth IRA until they retire, Foust said.

By putting their money into the Roth TSP they are taxed on the contributions based on their current tax bracket, which is generally lower when you’re younger. In a traditional TSP, you’re taxed at your rate at the time you withdraw the funds, after you’re 59 1/2.

Foust didn’t make recommendations regarding the types of funds they are using; veering instead toward education. Jose puts 100 percent of his TSP contributions into the C Fund (Common Stock Index), although because of allocations in prior years, his overall TSP stands at 75 percent C Fund; 20 percent I Fund (International Stock Index); and 5 percent S Fund (Small Cap Stock Index).

Katrina’s TSP allocation is set up to mimic a 70 percent total market index and 30% international (55 percent C Fund, 15 percent S Fund, 30 percent I fund.)

Their take

For now, the two are satisfied with $30,000 in their emergency fund, which is about six months of living expenses. As Jose gets closer to retirement, they’ll probably ramp up emergency savings to about $70,000.

If they do live on one income for a while, Jose will continue to max out his TSP and IRA contributions and fully fund Katrina’s Roth IRA. Katrina is considering using her post-911 GI Bill to go back to school, too.

When they’re able to retire, it doesn’t necessarily mean they’ll stop working. But it means financial freedom, Jose said.

“We won’t have to work if we don’t want to. We can do what we want to do,” he said.

Editor’s note: This story has been updated at the request of the airmen to remove their last name and photo.

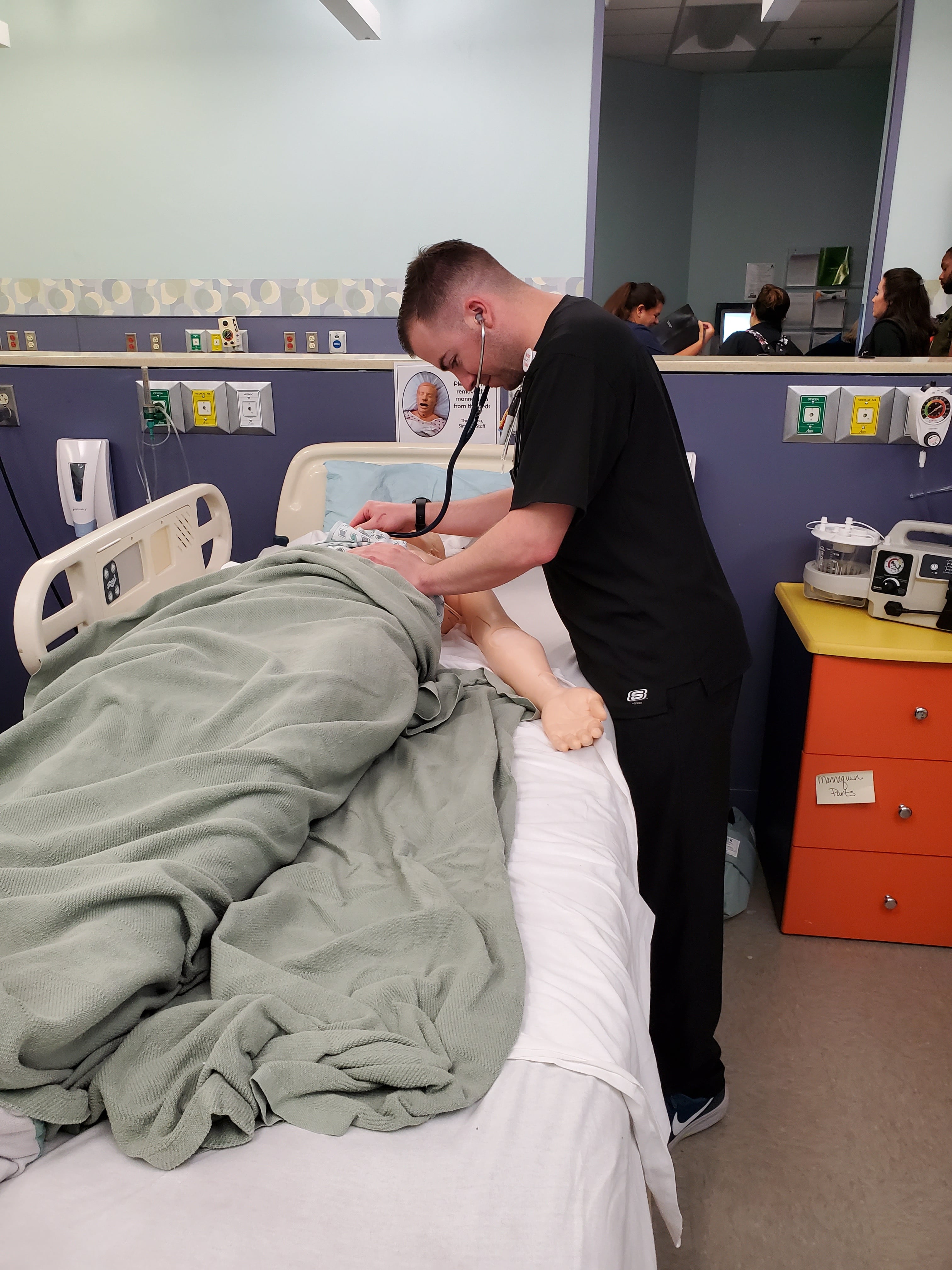

Army Reserve Sgt. Thomas Jordan

Army reservist, 30, single, just started his civilian career as a nurse in a hospital in El Paso, Texas, Combined income roughly $74,000 annually.

Retirement snapshot:

Thrift Savings Plan: $10,259 (including DoD match and earnings of $407, based on Reserve pay in BRS)

Roth IRA: $3,000

Other investments outside retirement: $4,600

Emergency fund: $13,000

Total assets: $30,859

Debt: Car loan, $7,000, at 2.5 percent APR

Army Reserve Sgt. Thomas Jordan has set a goal of accumulating $5 million by the time he retires at age 65, hoping to live off the earnings of his stash.

The 30-year-old has accumulated about $31,000, but his savings engine has just begun to rev up. He just started his second career, as a nurse at a hospital in El Paso, after recently finishing his nursing degree. He estimates an annual income of about $56,000 from his civilian nurse job, plus another $13,000 a year in VA disability; and roughly $5,000 in Reserve pay.

Jordan has certainly developed the savings habit, continuing even while he was going to school. His careful spending habits haven’t changed much, even though his income has gotten a big boost.

For nearly four years before he left active duty as an Army medic in July, 2016, Jordan was contributing 10 percent of his active duty pay to his TSP, which now stands at $10,259. He switched to the Blended Retirement System in January 2018, and contributes 10 percent of his Reserve pay to his TSP. With the full 5 percent matching funds, the DoD match and its earnings have grown to $407.

Jordan also has another $3,000 in a separate Roth Individual Retirement Account; about $4,600 in a non-retirement brokerage account; and another $13,000 in his “rainy day fund.”

The recommendations

“Thomas has done a great job with his finances as he’s navigated his way through school using the Post 9-11 GI Bill/VA Vocational Rehab program,” said JJ Montanaro, a certified financial planner in the military affairs division of USAA. Other than a $7,000 car loan, Jordan has no debt. Given what he’s been through, starting over and going through school, accumulating $31,000 in savings and investments is pretty good, Montanaro said.

“He’s in a really good position to launch things" he said, with these recommendations:

Consider contributing 15 percent to his 403(b) retirement account through his new employer.

Fully fund his Roth IRA for 2019 by transferring $6,000 from his rainy-day fund.

Establish an automatic transfer from his civilian paycheck to his rainy-day fund, at a minimum of $200 per pay period; periodically reevaluate the amount and move some to IRA or longer-term investments in non-retirement accounts.

Diversify investments. About 95 percent of Jordan’s investments are in stocks of large U.S. companies, including his TSP, which is all invested in the C Fund (Common Stock). Jordan should include other investments aligning with his more aggressive approach, like smaller U.S. companies, stocks from abroad, and other types such as real estate investment trusts and commodities.

Expand the use of the non-retirement account, and beef it up. Not all goals will be retirement-oriented, and these funds can be withdrawn for other purposes before retirement age — such as funding further nursing education.

Assess that goal to accumulate $5 million, which is likely to generate more than $60,000 in income annually. The reality is that using the 4 percent withdrawal rate as a general guide, he’d have about $200,000 in his first year of retirement, with a $5 million stash, Montanaro said.

Jordan is on currently on track to reach about half that. However, given his increased earning power now and in the future, the $5 million is achievable, so he should build a “glide path” to track progress.

Jordan’s take

“He taught me a lot of things I should be doing, and he reiterated how important it was to take these steps,” Jordan said, following the review.

He’s already taken some steps. In response to Montanaro’s general information about funds, Jordan created his own lifecycle-type fund in his TSP, dropping his contributions to the C Fund to 60 percent, and diversifying with 15 percent to the I Fund (International Stock); 15 percent to the S Fund (Small Cap Stock); 5 percent to the F Fund (Fixed Income); and 5 percent to the G Fund (Government Securities.)

Jordan took $2,500 from his rainy day fund to add to his Roth IRA, and has already replenished the emergency fund after a couple of paychecks.

Once he gets settled in his finances and sorts out his contributions to his new employer’s 403(b) plan, Jordan plans to increase the investments in his non-retirement investment account, and his IRA. He’ll review his finances in three to six months.

Montanaro’s review, he said, “was really helpful in opening my eyes and showing me better ways to invest my money.”

Jordan hopes to go back to school to be a certified nurse anesthetist — a significant boost in income. Otherwise, he understands it will be more difficult to reach his ultimate $5 million goal.

He acknowledges if he doesn’t get close to that end goal, he might be dipping into the principal when he retires. “But I would like to leave this world a better place than I found it," he said.

“I’ll obviously give some to my family, but donate the majority of it to charity.”

Karen has covered military families, quality of life and consumer issues for Military Times for more than 30 years, and is co-author of a chapter on media coverage of military families in the book "A Battle Plan for Supporting Military Families." She previously worked for newspapers in Guam, Norfolk, Jacksonville, Fla., and Athens, Ga.